HOUSING SPECIAL

13 December 2023

Given its specificity and media impact, I have chosen to deal with the GOLDEN VISA scheme separately from the chapter about DEMAND.

Unfortunately, this media coverage has not been without a marked polarization between those who value this instrument as a driver of a healthy economy and those who point out its harmful effects on access to housing.

These two legitimate positions, unfortunately, have promoted a debate based on economic interests and ideological prejudices.

In presenting this HOUSING SPECIAL, I committed myself to making a series of independent and impartial reflections. This is only possible with transparency.

Before starting this chapter, it's important to remember that I'm a real estate agent. And that, in 2021 and 2022, 46% and 21% respectively of my income was obtained by representing buyers from other nationalities who closed real estate investments, through which they applied for a Residence Permit for Investment, the so-called Golden Visa.

Having said all this, I reaffirm my impartiality and independence in writing this review. Being obviously up to the reader to make that assessment.

By Sergey.

WHAT IS THE GOLDEN VISA?

The Residence Permit for Investment Activity (ARI) regime, known as the "golden visa", allows foreign citizens, through an investment activity:

- Enter Portugal without a residence visa;

- Reside and work in Portugal, with a minimum stay of no less than 7 days in the first year and no less than 14 days in subsequent years;

- Move around the Schengen area without the need for a visa;

- Benefit from family reunification;

- Apply for a Permanent Residence Permit under the terms of the Foreigners Law;

- Be able to acquire Portuguese nationality by naturalization if the other requirements of the Nationality Law are met.

This investment activity could take place in 8 different ways, 2 of which were through the acquisition of real estate:

- Acquisition of real estate worth €500,000 or more. When located in low-density areas, the investment could start at €400,000 (-20%);

- Acquisition of real estate that has been completed for at least 30 years or located in an urban rehabilitation area and carrying out rehabilitation works on the real estate acquired for a total amount equal to or greater than 350,000 euros. When situated in low-density areas, the investment could start at €280,000 (-20 %).

Personally, I have little sympathy for the idea of paying to obtain a visa or acquiring a given citizenship.

That said, there is a context for creating golden visas that must be considered.

HOW AND WHEN DID THIS REGIME APPEAR?

The golden visa regime came into force on October 8, 2012.

It's important to remember that in 2011, the uncontrolled sovereign debt and rising interest rates were strangling Portugal. This context forced the resignation of a prime minister and a request for foreign assistance (bailout). This was responsible for the presence in Portugal, until May 2014, of a delegation made up of representatives from the European Central Bank, the European Commission, and the International Monetary Fund.

The new government was obliged to cut spending and find new sources of revenue.

In just a few years, Portugal has gone from a country in a pre-bankruptcy scenario, where it seemed unsafe to put money, to the front pages of investment menus.

This change is due to a series of measures (some carried out by the European Central Bank) and a universe of dynamics that are difficult to list in a sentence or paragraph, contributing to the country's growing visibility. What impacted the perception of Portugal, its ability to cope with foreign debt, and the dynamism of its economy.

And yes, in some way the golden visa is part of this transformation.

TOTAL Nº. OF GOLDEN VISAS GRANTED

AND Nº. OF VISAS GRANTED BY INVESTMENT CATEGORY

(2012 - 2023)

Source: Serviço de Estrangeiros e Fronteiras.

The most noticeable piece of information from the analysis of Graph 1 is that the overwhelming majority of golden visas (89.5%) were granted to real estate investors.

This is the first issue that needs to be discussed: was this the intention of the law that introduced golden visas? If the purpose was to boost the real estate market, it seems to have worked perfectly. If, on the other hand, it was supposed to generate a significant number of jobs, the failure is resounding.

Let's assume that the real estate leverage made sense in 2012. Would that still be the case half a dozen years later? It seems clear that it isn't.

Without clear and well-defined objectives, it's difficult to take stock and think about possible adjustments or improvements.

Another relevant note: there is a time lag between the moment the investment is made (in the case of buying real estate, by signing a contract or promissory contract of purchase and sale) and the granting of the visa.

In other words, the fact that a record number of golden visas may be granted in 2023 (the graph for this year refers to residence permits granted between January and September) does not mean that many of these types of investments have taken place this year.

To give you a temporal reference: none of my clients who made investments in the 2nd half of 2021 obtained their visas before the 4th quarter of 2023.

I'm absolutely convinced that the rise in the number of golden visas granted in 2023 is due to a spike in house purchases in Lisbon during 2021. And why is that?

On February 12 of that year, an amendment to the law was published in the Diário da República, the most relevant change of which was the following: as of January 1, 2022, it would no longer be possible to apply for an ARI through the purchase of residential properties, in a large part of the coastal strip of mainland Portugal.

This means that if someone wanted to invest in real estate located in the Lisbon metropolitan area or the municipality of Porto, they would have to do so through the acquisition of non-residential property... or close on purchasing a house or apartment by December 2021.

WHICH NATIONALITIES?

2022 was the only year in which the most significant number of golden visas was not granted to Chinese citizens. But by tiny: US citizens outnumbered Chinese citizens by only 3 visas, an advantage that should be further extended in 2023.

That said, according to the recently defunct Foreigners and Borders Service (SEF), of the 12,718 golden visas granted between October 2012 and September 2023, 5,401 (42.5%) were issued to Chinese citizens. This rise was even more evident in the program's initial years: by 2016, this nationality accounted for 72.6% of all visas granted.

Why might this information be important? Have you ever heard of houses bought by gold visa holders that have yet to be occupied? Or under-occupied condominiums? This is a phenomenon whose magnitude cannot be quantified but may be associated with communication barriers and a lack of transparency on the part of some local actors.

As you can imagine, there is no data on these occurrences, but it is said among mediators and real estate agents that, at an early stage, houses were sold for €500,000 to Chinese citizens, which would have been available on the market for less.

In other words, properties that would hardly have been sold for half a million euros in a transparent and informed market. But when presented to people who spoke neither Portuguese nor English, who needed help understanding the market and were poorly advised, they were bought for these amounts. A black page in the history of national real estate brokerage that nobody seems to care much about.

These occurrences have two harmful effects on the residential market: they artificially increase prices and boycott the supply of rental housing.

WHERE ARE THE PROPERTIES?

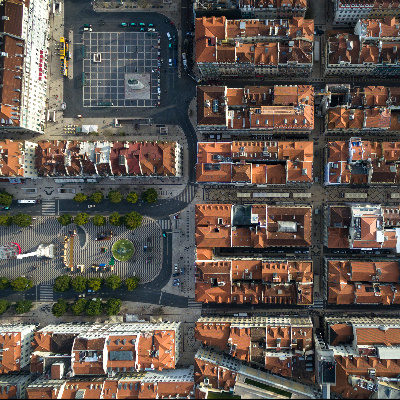

Graph 2 refers to 2021 and 2022 and compares the total number of visas granted with the number of property acquisitions in the five municipalities that attracted the most investment in this way, which the newspaper ECO found out from SEF. These results are very similar to those published in an article in the Público newspaper, which states - also based on data provided by SEF - that 55% of the golden visas granted between January and September 2019 were for acquiring real estate in the municipality of Lisbon.

The big picture is that around 50% of the golden visas granted among all the investment categories available since 2012 have resulted from purchasing real estate in Lisbon. In other words, the program has generated more house purchases in Lisbon than in the other 307 municipalities nationwide.

TOTAL Nº. OF VISAS ISSUED

AND Nº. OF VISAS GRANTED

VIA PROPERTY PURCHASE

IN 5 MUNICIPALITIES IN 2021 AND 2022

Fonte: SEF, via ECO newspaper.

By Celt Studio.

THE ANALYSIS THAT REMAINS TO BE DONE

A golden visa is a form of investment that used to require foreign citizens to spend between one and two weeks a year in Portugal and choose one of 8 possible investment forms.

Of these 8 possible forms of investment that the golden visas allowed, at least half seemed to require a good deal of dedication:

-

Creating 10 jobs

-

Investing €500,000 in scientific research activities

-

Investing €250,000 in artistic production or the restoration of cultural heritage

-

Setting up a company and creating 5 jobs

Let's face it: transferring 1 million euros (1.5 million euros since 2022) to a financial investment in Portugal or buying a property for 500,000 euros seems more straightforward to invest in a foreign country, especially if the most important thing you want to obtain is a residence permit that allows you to move freely around Europe.

And while opening a bank account and wiring money is quicker than buying a property, €1,000,000 and €1,500,000 are double and triple €500,000...

We should be aware that, the design of this investment vehicle didn't manage to promote the attraction of people looking to get involved with the country. Nor did it make investments that couldn't be reversed relatively easily (but I can also understand that, in 2012, the country couldn't afford to demand more).

Every week, I read an article in which someone recalls the 6.5 billion euros of foreign investment for which the golden visas are responsible. But what is the real added value for our economy of a type of investment that essentially translates into property transfer?

With such a strong demand for housing compared to the available supply, there is a consensus that those who sold the properties would have done so without the contribution of these investors. And that the corresponding tax revenue would appear, even if a little later or for lower amounts.

Evoking that gold visas constitute a significant source of "foreign direct investment" is a somewhat naive argument.

It is essential to understand the added value that this investment generates. In the same way, when we talk about the negative impact on housing, we need to know where this effect is taking place.

By Robert N Brown.

WHO IS TELLING THE TRUTH?

A real estate sector that shouts almost in choir that the number of gold visas generates investment but has no impact on housing prices?

Or a faction of the political spectrum that accuses the government of promoting real estate speculation and hindering access to housing?

First of all, in a country experiencing a housing crisis, it seems elementary to me to recognize that, from the outset, it doesn't make sense to promote the issuing of visas through the purchase of houses. And I'm afraid I have to disagree with the claim that the housing crisis results from rising interest rates. The challenges of housing have already been widely discussed. For some years now, there has been a collective awareness (supported by robust indicators) that the evolution of residential property prices is (very) far from being matched by household incomes.

Secondly, it's hard to imagine that the golden visas have significantly impacted housing prices in municipalities other than Lisbon (or, less seriously, in Cascais, Porto, or some municipalities in the Algarve). Although I don't consider the contagion effect to be insignificant – in a "sellers' market," boosted by low-interest rates, in which demand for assets exceeds supply – that this price expectation may have had on neighboring municipalities. That said, the idea that everything would be solved by preventing investors in residential properties in the capital from being granted visas is unrealistic. The most likely effect of such a measure would be the migration of this housing pressure to Cascais, Oeiras, or Sintra.

The truth is this: if you intend to sell a house with an estimated market value of around €400,000/€450,000, and you know about the existence of an investment program such as the golden visa, you will likely put the property on the market for €500,000 or more (and in my role as a real estate agent, I would probably have advised you to do so).

No economic agent (be it a quoted company or a private citizen) wants to sell for 4 what they think someone else will be able to buy for 5. And no one is worse for trying to get a better deal.

The responsibility lies with the State, which should ensure the monitoring of an investment program that 2012 set a minimum purchase amount of €500,000. At the time, this seemed far from impacting middle-class market values (in the 2nd quarter of 2012, the average sale price of a house in Portugal was just over €105,000, and just under €138,000 in the Lisbon Metropolitan Area).

But it's also important to remember that in 2012, returning to the context of the appearance of this program and recognizing that this fact seems more like irony, the problem for many people was precisely the devaluation of their homes. I remember that we were living in times of "austerity" (voted "word of the year" in Portugal in 2011): unemployment had skyrocketed, and the national average wage was stagnant.

Some of those who were struggling to pay for their homes were unable to pay off their debts to the bank by selling them because, with loans financing 100% of the property's appraised value and houses registering successive devaluations, the result of the sale might not be enough to pay off the mortgage to the bank.

By Skórzewiak.

WHERE DO WE STAND?

The question is not about whether the golden visas are good or bad. Audiences and clicks tend to favor scenarios of opposition and confrontation, and the quality of the information provided by the media suffers as a result.

The most important thing to remember is that measures generate opportunities and risks. And that monitoring them is essential to prevent negative externalities from arising.

That said, it is regrettable to note that the government officials who today are proud to have announced the end of gold visas (which is not exactly true either), are the same ones who have not obliged themselves, year after year, to monitor the program properly. To look at the data provided by the SEF and realize that around 90% of the investment was channeled into the purchase of real estate (presumably the vast majority of them residential properties) and that more than 50% of these purchases took place in Lisbon.

If this had been done, I'm sure that, half a dozen years after the program started, the minimum amount to invest in a residential property in pressure areas would have increased, for example, to €750,000 or €1,000,000. Or that investment in housing had been limited to urban rehabilitation. Would the investment have been lower? Certainly, but perhaps it wouldn't have raised so many antibodies and disappeared in the meantime. And we would have ensured that foreign investment served the country and not the other way around.

These are just two examples of how the program could be protected - in a scenario that wouldn't even exclude the residential segment from the equation - with a significant mitigation of its risks for the housing market. By ensuring that the middle class is not harmed or limiting this type of investment to one that generates more visible economic impacts. Because redeveloping or renovating a property creates value, it can transform an unhealthy space into a home, generate consumption and employment, and ensure the provision of many services beyond legal and real estate advice.

I believe that maintaining the golden visa program as it was designed in 2012 would be, socially speaking, almost criminal. And an attack, in the eyes of all residents (particularly Lisbon residents), whose work does not allow them to live in decent conditions.

To completely cross out investment in real estate, regardless of its use, with the justification - only partially true - that it penalizes housing prices is testimony to the lack of transparency in political discourse. If only for the most obvious reasons: investment in offices or stores is not directly responsible for the rise in house prices.

The following article in this HOUSING SPECIAL is dedicated to the status of NON-HABITUAL RESIDENTS.