House prices

09 May 2022

After such acute (and legitimate) speculation, we are all eager to understand the real impact of the greatest pandemic of the last 100 years on house prices.

The publication of House Price Statistics at Local Level for the 4th quarter of 2021 allows us to trace - over 2 years - the evolution of house prices during the COVID-19 pandemic in Portugal.

The starting point for all data is 4Q 2019, the last quarter in Portugal in which the residential market, the economy, or the most mundane in our daily routines were still taking place without any constraints of a pandemic nature or origin.

By Gustavo Frazão.

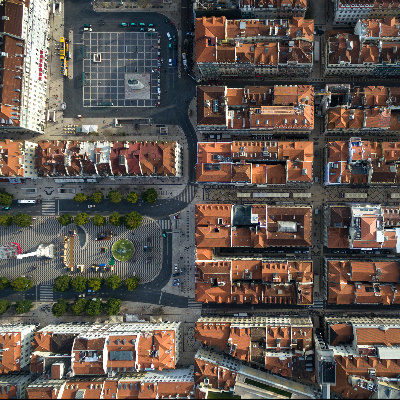

MUNICIPALITIES IN THE LISBON METROPOLITAN AREA

Source: Statistics Portugal.

Table 1 [the values in red represent price drops compared to the previous quarter and the ones in bold register peaks in that municipality during the period in question] shows that house prices in the Lisbon Metropolitan Area (LMA) have increased at a consistent pace. To the point where we can verify that in all 18 municipalities of the LMA, historical maximums were registered in the last available quarter.

At first glance, the municipalities most affected by the pandemic may seem to have been Lisbon and Alcochete. Since, during the period under analysis, they were the only municipalities to register decreases in two quarters.

But if we look at the last column of the table – which gives us the total variation between 4Q 2019 and 4Q 2021 – we can see that Alcochete was also the municipality where the median price/m2 increased most. Or why not say... skyrocketed? The houses in Alcochete appreciated 45% in just 2 years.

On the other hand, it was in Lisbon that property price appreciation took place at a slower pace. Prices/m2 in the capital increased by "only" 8.75% between the last quarters of 2019 and 2021.

It is important to remember that, since Lisbon was the municipality most pressured by foreign demand, it was plausible and expected that during periods when the movement of people between countries was so drastically limited, the pandemic would mostly affect the demand for housing in the capital, rather than in other municipalities.

By FSEID.

LISBON CITY PARISHES

Source: Statistics Portugal.

Let us start with the most obvious: prices in the parishes of Misericórdia and Santa Maria Maior decreased. The explanation seems relatively clear to me. These two parishes were among the most impacted by the limitations on short-term rentals (STR). These began in November 2018 with the introduction of the so-called "containment zones", making it impossible to issue new licenses in the neighborhoods of Bairro Alto/Madragoa (which cover a large part of Misericórdia) and Castelo/Alfama/Mouraria (which are a significant part of the area covered by Santa Maria Maior), and were expanded a year later to other areas, of which I highlight the entire Pombaline downtown (also included in Santa Maria Maior).

Let us recall: one of the reasons for the price appreciation of apartments in historic and central areas of Lisbon was related to the high profitability generated by the exploitation of STR units. The introduction of containment zones had two practical consequences:

1) new licenses were impossible to issue in those areas;

2) active licenses were expired (allocated to the license holder and not the property) after the sale of the apartment in question.

Additionally, there were the effects of the pandemic on tourism. That is, the owners of apartments allocated to STR, after finding themselves unable to value a potential sale of their apartments due to the attractiveness of the income they generated (since the next owner would no longer be allowed to continue this business), also found themselves, due to the brutal impact that the pandemic had on tourism, prevented from continuing to replicate the high yields of previous years. It is therefore coherent that market values have slowed down, or even decreased in those two parishes.

On the other hand, I must draw attention to the fact that, in 4Q 2020, the median sale values in Santa Maria Maior increased 10% when compared to the previous quarter, and exceeded (with considerable advantage), the transaction values in Santo António. It is difficult to understand what justified such high speculation on price/m2 in that parish during the pandemic. Could it be that there were foreign investors "to whom it was not explained" that it would be impossible to issue new STR licenses?

It is important to remember that– until about 10 years ago – Baixa was a decaying area with an aging population, in which other Lisbon residents did not seem to show much interest. Something that, in truth, has not changed significantly. The demand in downtown Lisbon (and the revival of its buildings) is essentially due to the interest of foreigners. As well as the interest of investors, in order to monetize the interest... of foreigners.

And it was precisely to foreign investors that I began to advise against investing in Baixa. With the argument that, without resorting to STR, the profitability of apartments in that area should fall significantly. And also, because the pressure of national demand is practically insignificant there.

In the same table, but further down, the parishes where dwellings appreciated by more than 20% in just two years are Carnide and Lumiar. Being that Marvila reached 19% (but Marvila is a whole other story, which I will try to explain in the next article), and Olivais and Beato in two years surpassed the 15% mark in price appreciation.

By trabantos.

MUNICIPALITIES IN THE PORTO METROPOLITAN AREA

Source: Statistics Portugal.

When we examine Table 3 [the values in red represent price drops compared to the previous quarter and the ones in bold register peaks in that municipality during the period in question], we realize that, apart from the municipality of São João da Madeira, the transaction values of houses in the Porto Metropolitan Area (PMA) illustrate the same reality seen in the LMA. Demand pressure, fueled by liquidity and low interest rates, has been evident in the last two years.

It is still surprising that, while granting moratoriums (in 2020 Portugal was by far, according to DBRS, the country with the highest ratio of mortgage defaults), national banks continued to finance the economy and, in particular, house purchases.

The appreciation of house prices in the metropolitan areas of Lisbon and Porto (which, according to the 2021 census, represent more than 4.5 million people), is largely responsible for the prominence that has been given to this issue at a national level.

By ESB Professional.

PORTO CITY PARISHES

Source: Statistics Portugal.

In the city of Oporto and according to Table 4 [the values in red show the price drops compared to the previous quarter, the values in bold register the peaks in that parish during the period in question], we must highlight the parish of Campanhã, which, in just 2 years, had a price appreciation of 70%.

Even presuming (in a context of urban rehabilitation), that the purchase of a vacant building at moment X, will predictably lead to sales of new apartments at a much higher value/m2 at moment Y (by adding value from the project development and respective works), it is still a surprising appreciation.

That parish has witnessed the same ripple effect that was first felt in Lisbon, and then in (even) more central areas of the city of Oporto. Where neighborhoods seen as decaying until recently, are now perceived as "cool places" or the so-called "places to be". The effect of urban rehabilitation is impressive.

By Kite_rin.

MUNICIPALITIES OF THE DISTRICT CAPITALS AND THE REGIONAL GOVERNMENTS OF THE AZORES AND MADEIRA CAPITALS

Source: Statistics Portugal.

It is curious that this table, being an attempt (even if timid) to extend the analysis of the residential market beyond the areas bordering Lisbon and Oporto, informs us that it is in Setúbal and Braga that prices have evolved the most during the pandemic.

Since despite being district capitals, these two cities are both two urban centers (that are) partially satellites of Lisbon and Oporto.

Personally, I am curious to see if the end of the eligibility of the acquisition of residential properties for golden visa purposes in most of the country (LMA, PMA, almost the entire Algarve and a large part of the national coast; click here to remember all changes to the regime), will be able to channel some of this investment to areas traditionally less disputed.

For now, this is only visible in the municipality of Grândola (better known for the Tróia peninsula, Melides and the proximity to Herdade da Comporta), where prices – between 4Q 2019 and 4Q 2021 – increased by 58%. Better... only in Campanhã.

By radub85.

CONCLUSIONS

It is quite clear that, against many expectations, house prices in Portugal have generally continued to increase during the pandemic.

But it is also important to remember that this does not mean that such expectations were foolish. We need to bear in mind that the pandemic period was marked by a very strong state intervention. And that measures such as the simplified layoff or the moratoriums for mortgage defaults had the merit of, in the least optimistic scenery, postponing problems and gaining time to find the answers to their resolution.

Or that even when these answers could not be found (because there were those who went bankrupt, lost their jobs, or were forced to sell their house), such situations happened:

1) in fewer number;

2) diluted over time (mitigating the danger that a high concentration of misfortunes in a small period of time would represent for the economy).

On the other hand, we cannot ignore that these measures had a price and that someday it will have to be paid, and that the prospect of rising interest rates is not the most pleasant scenario for a country, company, or individual, whose debt has increased.

But regarding housing, the idea that there are fewer houses available in Portugal, than those that are apparently needed to meet demand still seems to prevail.

Not to mention the construction costs that, after 2 years of a pandemic and more than 2 months of war, insist on continuing to increase.

And while the country's natural balance (the difference between those born and those who die) remains negative, the migratory balance has ensured a small growth in the resident population since 2019.

More and more, Portugal is on the top of mind of people throughout the world and many who wish to move country. Or simply invest in a country that sounds increasingly familiar to them, and on which they have more and more information.

BRIEF METHODOLOGICAL NOTE

All data shared in this article was sourced from the House Price Statistics at the local level of Statistics Portugal (INE), which immediately presents three methodological advantages over any report on housing prices in Portugal:

1) It refers to the actual transaction values and the Gross Private Area contained in the property's Tax Authority Property Description (thus ensuring consistent information on prices per square meter), that is only possible thanks to the existing protocol with the Tax and Customs Authority (AT), which provides INE with access to information of a fiscal nature;

2) It includes all property transactions in Portugal whose use is "housing", with a private gross area exceeding 20 sq. m. Just to give you an idea, the General Regulation for Urban Buildings defines 35 sq. m as the minimum area to be considered for a new building, reconstruction, restoration or demolition, for a studio.

And properties whose private gross area is less than 600 sq. m. Excluding, in this way, dwellings with such peculiar characteristics that they could bias the value per square meter of a given area.

3) The results published for each quarter correspond to the information registered for the reference quarter and for the three previous quarters, which enables significant mitigation of any eventual seasonal effects on the behavior of sales. In the specific case of the pandemic context, it makes sense to consider those discrepancies between quarters in which the restrictions in force were significantly different might be even more pronounced and evident than what the figures published by INE might suggest.