HOUSING SPECIAL

18 December 2023

The tax status of the NON-HABITUAL RESIDENT and the regime, usually called "Golden Visa", are often referred to in the same sentence, creating the perception that they are very similar programs.

But strictly speaking, they are not. Neither in terms of the nature of the advantage granted nor in terms of the type of relationship that most of the beneficiaries have with Portugal.

Not even in the numbers they generate: in 2022 alone, more than 16,000 non-habitual resident statuses were granted, compared to less than 13,000 golden visas issued in 12 years.

By Vitor Miranda.

WHAT IS A NON-HABITUAL RESIDENT?

The Non-Habitual Resident Status (NHR) is a special regime that offers new foreign residents and Portuguese citizens who have been emigrating for more than 5 years a reduction in Personal Income Tax (IRS) for 10 years.

To access this tax regime, the new resident must carry out a professional activity considered to have "high added value" or be a pensioner. They must also meet the requirements of a resident, which is to stay in Portugal for more than 183 days and have their own or rented home to use as their habitual abode. This incentive aims to attract qualified professionals in high-value-added activities and beneficiaries of pensions obtained abroad.

In other words, the first thing that should be made clear from the outset is that, unlike most citizens who have been granted "golden visas", these people live in Portugal, and what the designation "non-habitual resident" might suggest.

The second is that they benefit from a tax framework whereby they pay a flat rate of 10% on pensions (which were initially totally exempt), and 20% on professional income earned in Portugal. They are exempt from taxation in Portugal on income earned and taxed in their country of origin, whether from dependent or self-employed work, income from capital, property, or capital gains.

By sunakri.

TAX EQUITY AND THE PORTUGUESE CONTEXT

In Portugal (and worldwide), the tradition is that tax policy tends to promote a redistribution of wealth through the progressive taxation of income or the granting of subsidies.

But this is not necessarily a universal truth. And even in the so-called Western world, some differences can be found. For example, between the European tradition with a more substantial presence of the welfare state and the United States, where state intervention is less prevalent in the face of a greater appreciation of private initiative and its freedom to act.

As the Non-Habitual Resident status beneficiaries are assumed to have higher incomes, this measure tends to create a sense of social injustice, as these new residents are expected to pay a smaller share of their income than so-called traditional residents earning similar or lower incomes.

It may be pertinent to recall, to put the beliefs and convictions of the Portuguese on these matters into context, the proposal being defended by the Iniciativa Liberal ("Liberal Initiative"), which is considered - in economic terms - to be the most liberal of the parties with a seat at the Parlament:

The application of the same flat rate to all taxpayers.

This proposal is supported by the argument that (and whether you agree with the idea or not, it's a matter of stating a fact) applying a flat rate to all taxpayers ensures that those who earn more contribute more, and those who earn less pay less. In other words, the most neoliberal caucus in parliament wants everyone to contribute the same portion of their income.

What is at stake with the RNH is something more disruptive than what is proposed by the Liberal Initiative, which, in turn, is far from being consensual in Portugal. This tax regime encourages "new residents" with higher incomes to pay a lower percentage of their income to the IRS than "old residents" with lower incomes. The higher the income, the greater the tax benefit the "new taxpayer" obtains.

To be more precise, the 20% IRS tax on income earned in Portugal by people who are presumed to have higher incomes than the vast majority of the population means that, in 2023, these new residents will be subject to a lower tax burden than any resident, unmarried and without dependents, with a salary of €2,000 or more.

That's why it's called a "special regime".

By pio3.

HOW DOES THE RNH IMPACT THE RESIDENTIAL MARKET?

According to the Portuguese Court of Auditors, at the end of 2022, there were 74,258 residents taking advantage of this tax regime, 16,371 more than at the end of 2021. This is more than the total number of golden visas granted in 12 years and an annual variation significantly higher than the 10,808, 10,596, and 10,797 more beneficiaries (compared to the immediately preceding years) recorded in 2019, 2020, and 2021.

I would remind you that eligibility for this scheme requires that these people meet the residency requirements (stay more than 183 days in Portugal) and that they have as their usual address one of two things: a property that they own or on which there is a housing lease that identifies them as tenants.

In other words, this is a model for attracting foreign investment through a scheme that requires people to have a home in Portugal and live there. Which, of course, puts pressure on the demand for housing.

Just to give you a feel for the numbers: according to the National Statistics Institute (INE), in 2022, 167,900 houses were sold, and 92,572 new rental contracts were signed in Portugal. In a theoretical scenario in which all the latest beneficiaries of non-habitual resident status in 2022 had either bought or rented a house (since the regime obliges them to do one of these two things), the weight of each type of business would be 9.8% of transactions and 17.7% of rentals in the whole country. And of all the statements I've read on the subject, no one seems to know this scale.

How many buy and how many rent? And where? Unfortunately, we don't know (but we should). But whatever the distribution, everything points to the following conclusion: in 2022, non-habitual residents significantly impacted the demand for housing in Portugal.

I would also like to point out three things:

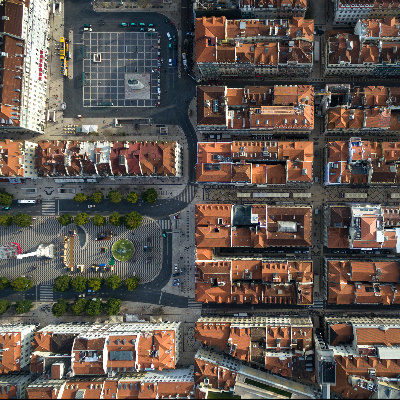

- It doesn't seem likely that these new residents are evenly distributed throughout the country; their presence is expected to be more marked in the metropolitan areas of Lisbon and Porto and in the Algarve, where the difficulties in accessing housing are already more evident;

- I would point out that these new residents (the overwhelming majority of whom are foreigners and must have their tax residence in Portugal) are evidence that the foreign tax residence criterion applied by the INE to weight the number of buyers of other nationalities generates a very significant underestimation of their real value. The number of new Non-Habitual Residents in 2022 alone is 1.5 higher than the 10,722 homebuyers in Portugal in 2022 with tax residence in another country.

- As we've already seen in the chapter on DEMAND, the pressure on housing prices is not only through buying but also through renting. Do you remember that, according to the Idealista Portal, more than 50% of the two-bedroom apartments advertised for rent in Lisbon cost €2,000 or more?

Por Radu Bercan.

AND THE BENEFITS?

Political agents may understand that "there is a price to pay for this statute" because they see benefits. And they do exist.

First and foremost, if we are effectively attracting new residents thanks to this scheme, the tax break itself is responsible for attracting new taxpayers and generating new revenue. However, in terms of personal income tax, until 2020, this wasn't true for pensioners since they were exempt.

When we talk about GOLDEN VISA, I accept that those who benefit most from them are mainly the real estate developers who sell the apartments, the agents (like me) who mediate the transactions, or the lawyers who handle the applications for residence permits.

However, this is unlikely to be true for non-habitual residents. As explained above, and contrary to what the name might suggest, the tax regime requires these citizens to reside in Portugal.

We're talking about immigrants who will stay in Portugal for as long as they can and want and who will benefit from an additional incentive to last for 10 years. These people contribute to the economy in the same way as other residents (or possibly more, assuming their higher incomes): they go to the supermarket, dine out, use public and private transport, wonder which school is best for their children, which gym suits them best, and share many other dilemmas with the rest of the population.

One of the most common arguments is that a scheme of this nature makes it financially more advantageous to attract someone with an activity considered to have "high added value" through a "tax rebate".

"All of this" is in a country that, in the context of Western Europe, still offers an attractive cost of living.

And, more than likely, foreign companies are considering establishing themselves in Portugal for the same reason: a more remarkable ability to attract talent via a financial benefit that is, so to speak, subsidized by the "tax discount" applied by the Portuguese state.

And add to this the usual arguments: mild weather, political and social stability (although, let's face it, housing is currently one of the weakest links in this equation), good internet coverage, better proficiency in English than any other country in southern Europe, etc, etc.

The questions I think it makes sense to ask are:

- Does it make sense to continue promoting a tax haven for high pensions? This issue has even led to minor diplomatic incidents with Finland and Sweden, which have yet to renew their agreements with Portugal to avoid double taxation, common agreements between countries worldwide.

- Is it true, as the defenders of this regime often claim, that these people would not have chosen to live in Portugal if it hadn't been for this tax regime? Or would they have taken advantage of an added benefit offered by the country where they chose to live? And if that's the case, is Portugal wasting tax revenue by providing a benefit that wasn't a determining factor in these new residents settling?

By photo-oxser.

DOES THE REGIME REALLY MAKE A DIFFERENCE?

Is it the non-habitual resident status per se that attracts new residents? Or have some of these new taxpayers merely taken advantage of an additional benefit that was not decisive in their choice of Portugal?

Let's look at the example made public of a foreign citizen who, on arrival in Portugal, applied for non-habitual resident status: Julen Lopetegui, the former coach of Futebol Clube do Porto (FCP).

The Spanish coach and former footballer had registered as a non-habitual resident, and his request was initially granted. According to the EXPRESSO newspaper, "For three years, between 2014 and 2016, the football coach only paid a 20% rate of IRS on the income he received from Futebol Clube do Porto, but at the end of 2018, he was faced with an additional assessment from the tax authorities, demanding that he pay IRS according to the general rules. At stake was an extra €800,000 in tax."

I have 2 convictions from this article:

- That, if at some point Julen Lopetegui had a chance of being a non-habitual resident (not to devalue the contribution of soccer to the national economy), it seems to me that the range of functions considered to have "high added value" could be rethought;

- Not only was the status of a non-habitual resident not decisive in this Spanish citizen's decision, but the coach probably was not even aware of the regime when he accepted FCP's offer.

Being an NHR beneficiary means that you have to live in Portugal. In many cases, we are discussing decisions that affect spouses and descendants. In other words, a whole universe of pros and cons will exist before a decision is made.

By this, I mean that I have my doubts as to whether, as some suggest, we are talking about people who, were it not for this regime, would never have chosen Portugal to live in. Or if, on the contrary, we are talking about new residents whose decision to move to Portugal was based on other criteria.

Even though the NHR can, even without being decisive, help a family decide to settle in Portugal or not leave the country when an exciting opportunity arises to do so.

THE PRICE OF DECISIONS

The 2009 State Budget law allowed for the creation of a tax regime to attract non-residents with high wealth, income, or qualifications so that they could establish their tax domicile in Portugal.

Much has changed in the last 15 years regarding the country's ability to attract foreign investment and the world's attention. And while it's true that the program has already changed, it seems equally true that developments in recent years may suggest some more.

As I said about golden visa, this type of program should be monitored regularly so that the state can understand whether the purpose of its creation is being achieved. And at what cost? In other words, what negative externalities might it be generating? And, better or worse, the government is trying to do. For the moment, consultants and legal experts are already trying to explore the potential of the new "tax incentive for scientific research and innovation".

According to the study "TAX BENEFITS IN PORTUGAL", on March 15, 2019, there were 29,901 non-habitual residents in Portugal, with only 2,205 (7.4%) carrying out an activity with high added value. This means that a very significant proportion of NHRs would be pensioners, generating 0 euros in IRS revenue since the 10% tax on pensions was only introduced in 2020. And it suggests that the tax revenue generated by these taxpayers could be much lower than the one perceived by the statute's defenders.

In any case, I think it's too hasty to end the regime. In fact, ending media schemes altogether overnight sounds like a lousy policy in terms of state marketing.

Which doesn't mean that we shouldn't bear in mind that one of the requirements of this scheme is to put pressure on housing prices. And the figures are precise: in 2022 alone, more than 16,000 beneficiaries had to buy or rent a home to secure the status.

And how many of these new residents chose to live in Portugal because of the decisive contribution of this benefit? Because if they were the majority, we have to recognize that the NHR per se brings (even) more challenges to housing. If that's the case, should we reduce/maximize the tax discount according to the beneficiary's place of residence to mitigate the increase in housing costs in geographic areas under more significant pressure?

On the other hand, should we accept that there is a price to pay for attracting talent in sectors considered strategic? And that the public interest will ultimately benefit? But is it reasonable to talk about the public interest without prioritizing housing shortages? Or would it be feasible to establish that the tax revenue generated by a program like RNH could be used to finance public housing?

And are the results of the 2019 study still accurate in 2023? And that the RNH has served much more as a mechanism for attracting pensioners than professional talent? And that, assuming that these pensioners don't have very different needs from the rest of us, a good number of them have chosen the Algarve to live in? If you read the first article in this SPECIAL ON HOUSING, you may remember that this is where 6 of the 10 most expensive municipalities to buy a house in Portugal are located...

On the other hand, given this hypothetical scenario, does narrowing down the range of professions make sense? Perhaps we merely need to exclude pensioners from the equation. Or, assuming that the problems of access to housing motivate the government, limit the tax benefit to pensioners who choose to live in low-density municipalities?

There's one thing we can all agree on; in 2009, the legislature couldn't predict housing prices 10 years later. We need more data. To ensure that we carry out more informed decision-making processes. Or, not least, to evaluate the government's measures.

This article is not intended to convince readers to express more sympathy or antipathy for this regime. Instead, it invites them to think about the issue more broadly.

And to question the categorical statements of those for whom "it is imperative to end the statute" or "it is stupid to end the NHR".

Because more often than would be desirable, the discourse of those to whom the media gives the stage doesn't seem to be very concerned with discussing all the impacts of a measure and understanding how they align with the public interest.