HOUSING SPECIAL

29 November 2023

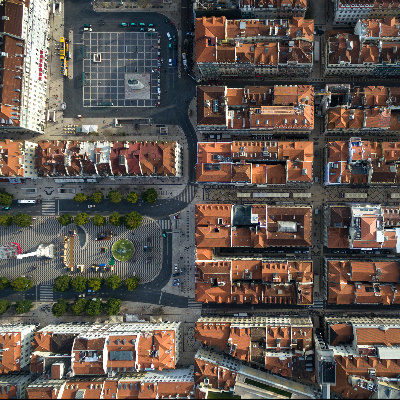

After a chapter dedicated to DEMOGRAPHICS and how it impacts the housing market, I will talk about SUPPLY, or if you prefer, the lack of it.

This is probably the most mentioned dimension when discussing the difficulties of access to housing in Portugal.

By Sittinam.

The best way to discuss the SUPPLY of housing in Portugal may well begin with an analysis of housing production. And that is precisely the information that Graph 1 displays: the evolution in the number of completed dwellings since the beginning of the century.

EVOLUTION OF THE NUMBER OF NEW RESIDENCES BUILT

(2001 - 2022)

Source: PORDATA.

It is true, for example, that 359.0% and 137.7% more homes were completed in 2003 and 2009 than in 2022. And there isn't much doubt that new construction and rehabilitating vacant buildings are the most obvious ways to fill the housing shortage.

What seems equally important is to try to understand the reason for such significant variations in the country's building capacity.

And remember that new construction statistics don't include the number of redeveloped properties. These have not only been very significant in the last 10 years but have also - in many cases - returned abandoned dwellings or units used for other purposes to the housing stock.

NOT TO FORGET THE PAST

It's important to realize that in the first decade of this century, 5.8 times more homes were built than in the following decade. This discrepancy is a strong indicator of how fewer homes are being built than should be necessary.

But it's also important to remember some things these higher construction figures can be linked to.

Between 2010 and 2014, almost 40,000 construction and real estate companies closed down. And, according to the Bank of Portugal's Financial Stability Report, in 2016, "these two sectors concentrated around 48% of overdue credit of non-financial companies", slightly down from 50.0% in 2014.

This portion of overdue credit seems to help explain why:

- At the beginning of the last decade, banks radically reversed their lending strategy and stopped financing construction;

- The total amount of housing mortgages granted from 2011 to 2015 (remember that the "bailout program" in Portugal took place between 2011 and 2014) was less than that contracted during the year 2022;

- Precisely 10 years ago, the percentage of debtors in default reached 29.6% and 14.4%, respectively, in non-financial companies and private individuals, as seen in Graph 2 by the Bank of Portugal.

DEFAULT BY PRIVATE INDIVIDUALS AND NON-FINANCIAL COMPANIES

(Jan 2009 - Sep 2023)

Source: Banco de Portugal.

The rise in bank defaults and the bankruptcy of so many companies in the sector seem to show that the volume of construction at the beginning of the century and the loans that leveraged it were not sustainable.

If these companies went out of business and the banks saw an increase in overdue mortgages, this seems to have happened essentially (although it is very rare for an occurrence to be justified by just one factor), because both overestimated the market value that these properties would have, or the capacity that someone would have to buy them when they were completed.

AND WHAT LESSONS CAN WE LEARN?

When in recent years - first during the pandemic and more recently in the face of inflation and the sudden rise in interest rates - economists and professionals in the sector claimed, and apparently rightly so, that the risk of experiencing a crisis like the subprime crisis again was significantly lower, because banks now had more robust equity ratios, and exhibited more discretion and prudence in granting credit, they were also distancing themselves from the past, leveraged to a large extent by the uninterrupted 100% financing of houses, from their construction through the promotion of development, until they were handed over to the end consumer, via mortgage loans.

In other words, we shouldn't wave the flag of financial stability by claiming that we can no longer repeat the mistakes of yesteryear and, at the same time, evoke the times when those same mistakes were made as an example to follow to solve a crisis in access to housing.

All I'm trying to say is that we need more construction, not because the philosophy or vision of yesteryear was more lucid or enlightened than today's (not least because it contributed to a financial crisis), but because importance must be given to the estimate of almost 14,000 families on the waiting list for affordable rents in 16 of the country's most populous municipalities, and to the many people living in housing shortages, about whom I don't believe there are very robust estimates, but whose existence and desires have been given greater visibility over the last year.

What must be remembered is that real estate is a a slow-producing asset. In other words, it takes years from when its construction is desired and planned until the product is finished. This time lag, from the moment a business plan is drawn up or a housing shortage assessed, to the completion of the operation, presents a brave new world of potential surprises, which can substantially change the premises of an investment, facilitating or compromising its initial purpose.

And this is, in essence, what happened during the subprime crisis: a succession of events that entrepreneurs and banks could not anticipate.

TIMINGS, LICENSING, AND ATTRACTING THE PRIVATE SECTOR

In recent years, there has been more talk of off-site prefabrication processes, which, according to some emerging voices, could positively impact the quality and speed of work. As well as their environmental impact and the safety of workers: in 2021, according to Eurostat, construction was responsible for 20% of work accidents that led to deaths.

But until this possible change takes place (and it's hard to imagine anything happening without state incentives), talking about the time it takes to produce a property invariably also means talking about licensing times.

Entrepreneurs linked to real estate development often complain about unjustified delays in licensing processes, which affect construction times and, necessarily, the final price of houses. In May of this year, Expresso reported that, according to the Portuguese Association of Real Estate Developers and Investors, licenses took 3 years at Lisbon City Hall (compared to 6 and 12 months in municipalities inland).

It would be interesting for developers to publicly share examples of licensing processes so that those not involved and familiar with them can understand how unjustified these delays are.

It would be a way of informing public opinion. But also to exert legitimate pressure on political action.

Testimonies about endless licensing processes have the most immediate consequences of making projects more expensive and increasing the risk of the whole operation.

And these two things almost always result in a third: a higher price for the property buyer.

On the other hand, the state has been unable to attract private initiatives. The now-resigned prime minister, António Costa, wanted 26,000 houses to be built in half a dozen years. This wish was expressed in 2018, to be realized by 2024, but by September of this year, only 1,400 homes had been completed. This can only be labeled a tremendous failure, which even he was forced to acknowledge.

Even now, Lisbon City Council is preparing to relaunch, in a different format, two public tenders for the construction of more than 500 homes in Benfica and Parque das Nações, which had failed to attract a single application between October 2021 and December 2022.

It's important to find value propositions that can capture the attention of real estate developers.

By Cavan.

THE IMPACT THAT FOREIGN DEMAND (SUPPOSEDLY) DOESN'T HAVE

In the previous chapter, dedicated to demographics, we saw that according to a publication on October 25 by the National Statistics Institute, "in the metropolitan areas of Porto and Lisbon, the median price (€/m2) of transactions carried out by buyers with a tax domicile abroad exceeded the price of transactions by buyers with a tax domicile in Portugal by 61.3% and 91.6%, respectively".

It is expected that, faced with a more significant number of foreigners buying homes at higher prices, real estate developers will focus on prime product segments. This positioning is expected to ensure a greater financial margin and less vulnerability to unfavorable economic cycles.

This logic is valid for all sectors: the emergence of a new population with greater purchasing power generates new business opportunities and, predictably, the arrival of new products and services to meet the needs of these new inhabitants, whether we're talking about restaurants and grocery stores, or international schools for the children of those settling in a new country.

A simple example: Until the end of 2021, when buying houses in the capital was still eligible for a golden visa, there were a number of developments whose target audience was clearly potential candidates for this visa. This is not my personal assessment, but the message conveyed by those promoting the projects and evidence recognized across the board by the entire sector.

The most tangible proof that foreign demand impacts the real estate market in some locations (and necessarily on the prices charged there) is that the housing supply has adapted to this demand. It's not a question of demonizing foreign demand or forgetting the good things it is responsible for. It's just to pay attention to some of the evidence. Because, with or without a golden visa and with or without non-habitual residents, a large part of the new developments available in Lisbon and Porto and some of the surrounding areas were or are developed with customers with greater purchasing power in mind. And almost always, a large proportion of these buyers are foreigners.

However, the priority is to increase the inventory of affordable housing for the middle class. If current market conditions seem unfavorable to this goal, it is up to the State to design solutions and incentives to make these projects attractive to private initiatives.

We'll come back to this topic later in the chapter dedicated to the role of the STATE. But next week, I will talk about the complementary dimension of supply: DEMAND.