Real Estate Brokerage

13 September 2020

Author's note

I am a RE / MAX Collection real estate consultant. Were this not my activity and I would hardly have the knowledge, experience and sensitivity to propose to write a piece on residential real estate brokerage in Portugal. That said, this article is – like all other contents on this page (whose editorial status I recommend reading) – a totally free and independent effort to bring you what seems to me relevant information on the topic. The purpose of this note is merely to ensure readers that they are always provided with all relevant information to draw their own conclusions.

What is real estate brokerage?

Real estate brokerage consists in the activity of companies promoting properties for sale, exchange, transfer and lease, on behalf of their clients; as well as searching for properties for those same purposes.

Real estate brokerage companies

The October 2019 report by the Institute of Public Markets for Real Estate and Construction (IMPIC, an institute under the supervision of the Ministry of Economy that regulates and supervises the construction and real estate sector) states that, on December 31, 2018, there were 6,257 companies in Portugal with a real estate brokerage license. Of which 4,552 IMPIC collected data on turnover and number of employees: 91.72%, 4.75% and 0.31% are, respectively, micro, small and medium-sized companies.

Many of the real estate brokerage companies, although legally independent, work under the umbrella of major real estate mediation brands. Being that, and still according to the IMPIC study, in the 2018 National TOP 20 (of which 18 are located in the Lisbon Metropolitan Area and 2 in the North Zone), there are companies with business volumes of between 6.5 and 28 million euros. But in this TOP 20 we also find companies whose core activity is in the commercial segment of real estate (JLL and CBRE), real estate developers, builders, managers and loan claimers. There are 11 companies left whose main activity is clearly real estate brokerage in the residential segment. Six of these eleven operate under the RE / MAX brand, one under PORTA DA FRENTE | CHRISTIE’S, another under JLL, one under DECISÕES E SOLUÇÕES, another under ZOME and another under ERA.

Real estate brokerage brands

I have no way of finding out how many real estate brokerage brands operate in Portugal, but it is easy to understand that, almost everywhere, small neighborhood brands co-exist with large international brands. It is evident that the latter dominate the public arena: be it due to their agencies’ visibility, advertising campaigns or even the presence of their agents on social media. It is also easy to imagine that internationally renowned brands are the most obvious references for foreign clients that have proliferated in Portugal in recent years. But this does not mean that there aren’t small brands in real estate brokerage that are totally modernized, or specialized in assisting foreign clients (as is the case with many companies operating in the Algarve).

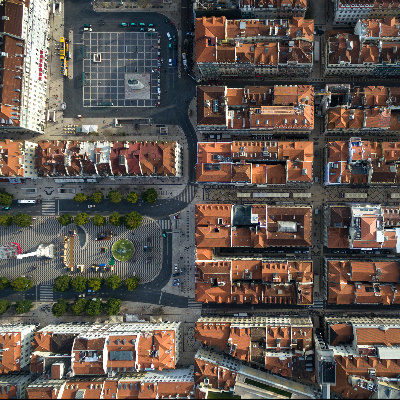

by astudio

What about technology?

There have been increased references to self-entitled technology-based brokerage brands. I looked up three companies I remembered, all of them widely announced by the national press in the summer of 2019. HOUSEFY promised to sell properties in 60 days. Currently, after a quick search on their website, I found 11 properties in the entire city of Lisbon (I know dozens of real estate agents with significantly larger personal portfolios). SHERLOCK was aiming for a 5% share in 2022 and a KAZZIFY representative claimed that “all transactions were made online”. Today I can't even find the website for either of these two brokerage brands.

It is cool to claim in an interview that the x, y or z algorithm is used, and it may even be true that the commission is lower than those charged by the brands we all know. But a company with a handful of employees working on commissions below market practice means two things: low potential to boost business and even lower capacity to attract partnerships with other real estate brands. And in all honesty, I don't see how the sum of the two can generate very attractive results. Resorting to big data can be useful to gain insight into price developments in a given area, but it is clearly insufficient to conduct a market study for a specific property. And it is not necessary to have an outstanding algorithm to sell a property with a 3D virtual tour. You only have to hire a company specialized in the production of photography and video, with adequate material to do it. The truth is, all these brands have done is rename the low-cost concept through a technological myth in the hope that a jovial communication would generate results. I don't think that saving money in promoting our most valuable asset is the best of strategies. And apparently, the market didn't believe it either.

by tampatra

Commissions: how, when and why?

For those who sell a house.

In Portugal, the overwhelming majority of the residential real estate brokerage business is invoiced to owners. In other words, when a mediator intermediates a house sale, a real estate brokerage contract is signed and a commission is defined. The payment of this commission is due if the mediator finds a buyer for the property in question. And most of the time, its value is defined by a percentage of the amount for which the transaction is closed, to which VAT is added at the rate in force.

For those who buy

Those looking for a house in Portugal do not, most of the time, formalize any kind of bond to a real estate agent. There is however a tendency for this relationship to start taking on formal grounds. The argument of the mediators who have invested in this type of approach is that, only by ensuring the remuneration of those who accompany them in the search for a house, will a buyer client ensure all the dedication of a real estate consultant. Which, despite not necessarily a universal truth, is certainly a very pertinent observation.

Exclusive or non-exclusive contract?

This is, as a general rule, one of the biggest uncertainties of those who decide to hand over the promotion of their house to mediation specialists. It is undeniable that a contract that does not require exclusivity provides an owner with more freedom of choice. On the other hand, and one can apply an elementary rationale here: the more working conditions you provide someone with, the better results you can expect. And the proof that an exclusive listing has more resources allocated to it is the following: any professional who is available to work non-exclusively will always list the additional resources that he can use, if you give him the opportunity to promote the property exclusively. My opinion is that if you choose the right person and brand, it’s better to have a good professional at your side working with all resources, than having two or three for which your house might be “just another one”. On the other hand, and this is also undeniable, a poor choice of real estate company and consultant to promote your property on an exclusive basis, can represent a greater loss. But there is a reason why two or more intermediaries do not necessarily reach a greater number of potential buyers than a single brokerage brand. And that reason is called sharing.

by sunakri

Sharing (or partnership)

This is, in my opinion, one of the words that you should hear most frequently from the person(s) to whom you consider granting the right to promote your properties. Sharing or partnership is the mechanism by which, in a context of real estate brokerage, two different parties split the commission of just one deal. Typically, when a real estate consultant talks to his client about sharing, he’s referring to the possibility of splitting the commission the owner agreed to pay, with other real estate brands. If this happens, the commission (which has to be defined in a real estate brokerage contract) is almost always shared equally between the real estate brokerage brand that listed the property and the real estate brokerage brand that found a buyer or tenant for the house in question.

This is not just a way to provide a better service to the client that you represent, and to remunerate each of the parties that contributed to closing a deal. It is also the mechanism that allows for something as elementary and desirable as the following: anyone who wants to buy or sell a house (or exchange or lease) does not have to contact each of the real estate brands in the country to try to cover the entire market.

Regarding this matter, I believe that the best practice is that of the brands that promote the properties directly associated to the agent responsible for their listing (that is, the person who earned the owner’s trust to promote it). This practice encourages immediate contact with the primary source of information and speeds up the entire chain of procedures that separate the moment when a property is listed for sale from the closing of the deal.

In some companies, through their policy with buyer customers, there is a third person between the final customer (or the agent of another real estate brand that represents him) and the professional responsible for the listing. This approach, in my opinion, tends to promote the loss of time, information, and most importantly, efficiency in promoting the property.

Brokerage brands for which partnership is not a current practice (and the consequences that this entails)

Not all real estate brands are willing to partner with their competitors and split commissions. And as of now, I would like to say the following about that. A real estate brokerage brand that does not partner with other agencies is making a very simple option: giving priority to retaining the commission in its entirety at the expense of expanding and widening the universe of people who know that the house is available and can therefore make an offer.

Specific examples? ERA only started to accept partnering with other brands in 2020. Communicating to an entire sales team that, after all, they are allowed to do what they were prevented from doing in latter years, constitutes a radical change in terms of organizational culture. So far, the clearest answer I got from contacts with agencies of the referred real estate brand was the following: send an email to the commercial director or manager so they can decide whether or not they can share that property. It is widely recognized that what will dictate the final decision will be their perception of being able to close the deal with a client who is a buyer in their scope. But is it necessary to highlight that the transaction value of a property may be radically influenced by the number of potential interested buyers? And that situations in which there are two or three offers for a property foresee a much more favorable deal for the owner? To boycott the entry of a potential interested party in the dispute for a property whose sale is being promoted, is to violate the assumption that the aim is to provide our client with the best possible deal (that is, to sell the house for the most interesting offer). Note the degree of absurdity at stake: the company that offers to promote the property is the same company that literally sends its potential market partners the message that “the house is not available to your clients”. We are referring to the second largest real estate brokerage network by total business volume in Portugal, so, acknowledging the numbers, ERA must be doing many things well.

SOTHEBY’S achieves the feat of having an even more restrictive policy on property sharing than ERA. The measure of this brokerage is so penalizing for the best interest of their own clients that, once the referred superior approval has been obtained so that another real estate brand can take a client to visit a property promoted by SOTHEBY'S, what they are willing to do is, according to themselves, a protocol in which the partner may receive between 10% and 20% of the commission. Which, in the great majority of cases, will mean that the other mediation agent will have – from a strictly financial point of view – a significantly weak motivation for his client to buy that property. And believe me, if you are the owner of a property for sale, what you most want is to have real estate agents of the most varied brands motivated to promote your house to their clients.

What is the consequence of this policy? Thousands and thousands of agents will ignore the sale of your house. So when you choose a real estate brokerage brand that does not share their listings with other brands, you are doing something very simple: reducing the chances of selling or renting your house. Because most likely, it will reach fewer people, fewer interested parties and have less offers. And like any other product on the market, your house’s perception of value is also conditioned by the number of people who may be interested in it. Less demand, less appreciation.

For this reason, signing an exclusive contract to promote your property with a brand that does not share commissions with other real estate brands (or does so only under the conditions described above), is an absolute irrationality. Another note for those who search for a house: do not expect a brand that does not split commissions with other brands to suggest you making a viewing (whether for purchase or lease) to a house that is not part of his stock. Typically, the brand priority will be selling its own inventory rather than presenting you with a wide selection of properties.

5%?

5% is the most common commission practiced in Portugal. And, as a rule, the amount charged by the vast majority of the largest brokerage brands in the market. More than reflecting on the fairness of this value, it is important to realize that, similar to what happens with the closing transaction amount for a given property, this is the value that the market dictated. If any promoter tries to sell you a 6% commission, he should have a good justification for doing so (I know it will seem like a joke, but SOTHEBY’S is one of the brands that usually practices 6%). What I can comment on that is: there must be good reasons to pay 20% more than the rest of the market. And if someone suggests charging less, this may also be a reason to question yourself. As a general rule, if a company is willing to offer prices below those of the competition, it is because it recognizes that its value proposition is less attractive than the others. Companies with fewer resources tend to have smaller client portfolios and, therefore, are more dependent on sharing business with other players (and if they charge 1% less, they have 0.5% less to offer). That is, paying below market price may lead to a simple consequence: the market may be less interested in what one has to offer.

The efficient promotion of your property should be your priority but having a sense of how the market works may also prove important.

To summarize

The Portuguese real estate brokerage market reflects significant diversity. Different strategies may have a considerable impact on the way your property is promoted or on the type of assistance paid to those looking for a house to buy or rent. And why not say the following? In the quality of both services. Buying and selling a house is almost always too large of a transaction for us not to worry about who to trust. I suggest you should always dedicate yourself to dissecting each brand (perception) to its value proposition (reality).

Obviously, it’s not the same to pay 4%, 5% or 6% of a transaction. But as in any other service provision, trying to understand the quality / price ratio of the service that is offered (the promotion of a property can involve a large investment), is a fundamental point to make the best decision. I believe that the trend is for brokerage brands to work increasingly better. But that will essentially depend on one thing: more demanding clients.